Fintech

Guarding financial security from payment transactions

Fintech

With the rapid development of mobile Internet and the industry-wide application of "Internet+" concept, more and more financial institutions are transferring their counter business, offline business, traditional PC business and other service contents to mobile Internet. This process of rapid new productization of financial business inevitably introduces a large number of new security issues, such as user account information leakage, transaction hijacking, theft of user funds and other mobile financial security issues occur from time to time.

Pain Points

Certification is not secure

Dependent on system authentication results, authentication can be easily bypassed or forged

Inconvenient to use

U shield, TF card and other physical methods of authentication security but not convenient

Higher cost

Authentication requires additional hardware implementation, increasing hardware costs

Solutions

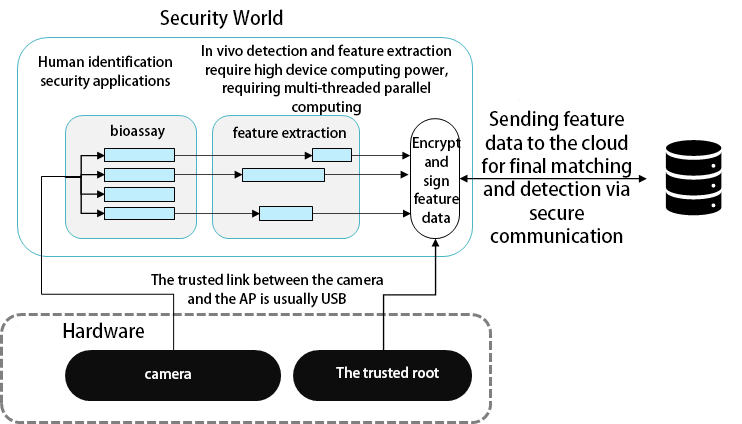

Solution Architecture Diagram

Solution deployment/introduction

-

Peripherals such as IR or TOF collect live information, and the CPU computes and determines whether the target is live or not.

-

The camera captures the face information and then extracts the feature data by a specific algorithm.

-

Extract the face feature data, send the feature data to the cloud through secure communication, and the cloud performs the final matching and detection.

-

The introduction of TEE protects the face acquisition and recognition process and ensures the privacy and integrity of face feature data

Core Features

High security

Using TEE technology to ensure that the operation is not disturbed to speed up the calculation speed

High versatility

Hardware-based trusted computing technology, more secure and reliable

Lower cost

No additional hardware support required

Easy to use

Perfect sdk, out of the box

Ultimate experience

Millisecond response, basically senseless to use

Cases

Face POS equipment

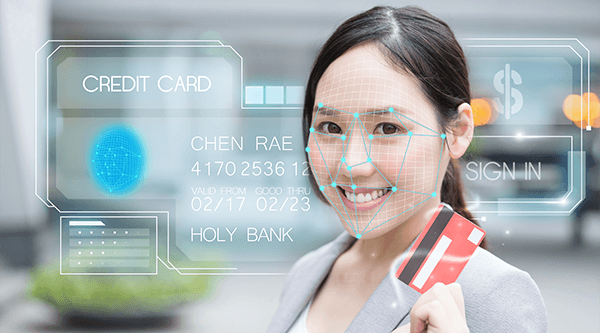

Face POS devices have brought great convenience to the payment industry and are being used more and more widely. A domestic manufacturer by integrating the security solution of the Trustkernel, face POS devices have a great advantage in terms of security and cost. Consumers can pay smoothly and conveniently by standing in front of the face POS device for a few seconds without money or a card or a cell phone, and then clicking to confirm.

Mobile application for secure user login

The traditional user login for mobile applications is done through username password, one-time password OTP, SMS verification code, etc. This information is easier to be stolen or tampered with, causing unnecessary losses. A mobile application integrates the chip-level security solution of Bottle Bowl, which allows users to log in securely with just a tap of a finger on the phone.

Smart devices enable access authorization

A domestic smart device manufacturer uses the chip-level security of the Trustkernel to enable secure and convenient access authorization for smart devices after the first registration. Relative to the traditional way high security, lower cost and easy to use.

沪公网安备31011202008280号

沪公网安备31011202008280号